Breadcrumb

- Home

- Melbourne Stories

- A Fund for the Planet: Planet Fund

A Fund for the Planet: Planet Fund

The Planet Fund, managed by a subsidiary of Ecotone Partners, is an investment fund focused on financing climate transition solutions.

About

The Planet Fund, managed by a subsidiary of Ecotone Partners, is an investment fund focused on financing climate transition solutions. It offers tailored funding via equity and/or structured debt to companies developing scalable and impactful technologies that address climate challenges. By prioritising companies with proven technology and the ability to deliver near term emission reductions, and that are profitable or near profitable, the Fund aims to deliver favourable investment returns alongside positive climate outcomes.

The Planet Fund is led by a team of seasoned professionals with extensive expertise in climate finance, private markets, and impact investing. The leadership team includes Amanda Goodman, Nicole Kleid Small, Jeremy Burke, and Dan Madhaven, each bringing a proven track record in structuring and managing investments across asset classes.

The team’s unique blend of financial acumen and deep climate expertise positions them to source, evaluate, and support high-quality companies with scalable solutions. Leveraging robust networks across government, industry, and climate sectors, the team has access to exceptional deal flow and collaboration opportunities.

Recognised as trusted and capable stewards of climate transition investments, The Planet Fund team is well-equipped to deliver meaningful outcomes for investors while accelerating the transition to a low-carbon future.

Why Melbourne

Melbourne is a strategic location for Planet Fund due to its strong climate-focused investment community, government support for sustainability initiatives, and access to skilled talent in climate finance and renewable technology sectors. The Planet Fund was also able to secure grant funding from LaunchVic’s VC Support Program to launch the fund in Victoria.

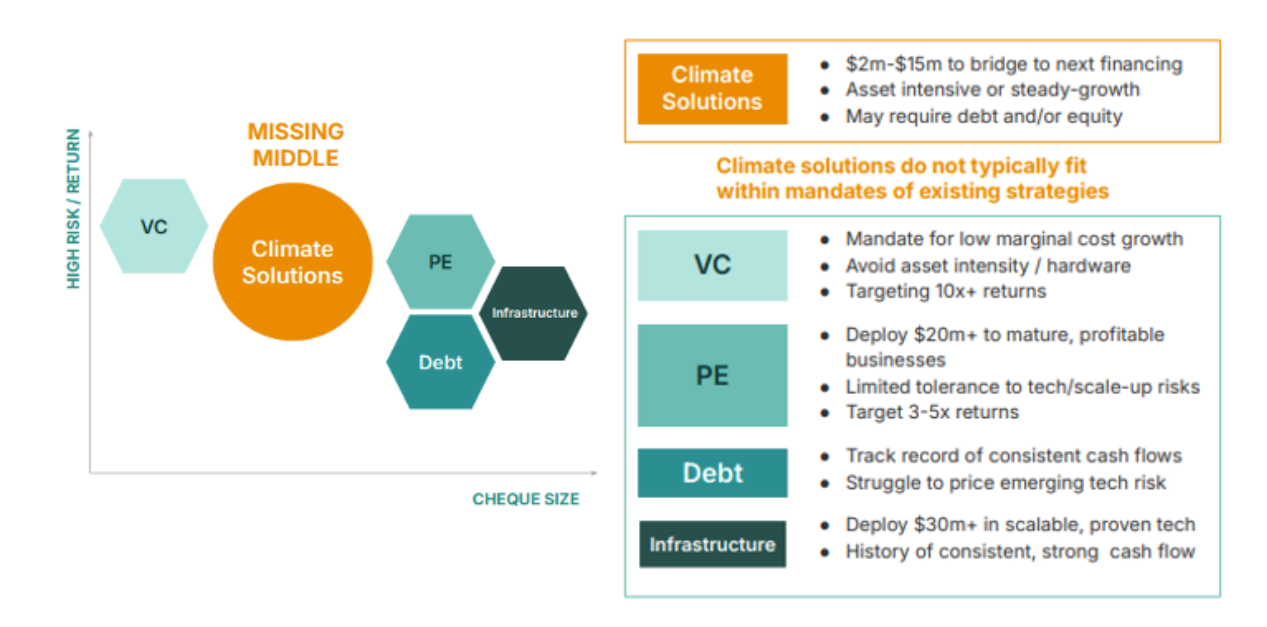

Traditional funding models are not equipped to meet the unique needs of many climate solutions. As a result, they can’t deploy capital at the scale and speed required and often overlook the urgency of reducing emissions in the near term.

Challenge

Due to a mismatch between the type of capital climate solutions require and what traditional funding sources offer, creating what we call the “missing middle” in climate finance. Many promising companies fall into this gap, unable to access the funding they need to scale.

Key challenges contributing to this mismatch include:

- Business Models: Climate solutions are often capital or asset-intensive, which are less appealing to VCs that prefer software-based, asset-light models.

- Cheque Size: Often the cheque size is too big for early stage VCs that need portfolio diversification and too small for private equity, private debt and infrastructure funds as they look to deploy large cheques into fewer companies.

- Risk and Return: The risk/return profile doesn’t align with traditional VC (returns are too low) or private equity, private debt and infrastructure (risk is too high).

- Debt and Equity Needs: Many climate solutions require a mix of debt and equity, which few investors can coordinate and execute effectively.

The Planet Fund is purpose-built to address this gap by providing tailored capital solutions that meet the unique funding needs of climate-focused companies. By bridging this “missing middle,” we aim to accelerate the deployment of scalable, impactful solutions to reduce emissions in the near term.

How big is the problem? Globally and locally.

To limit global warming to 2°C, trillions of dollars in annual climate investment is required worldwide. Despite this, many climate solutions remain underfunded, particularly those that can deliver near term impact.

Locally, Australia faces similar challenges, with emissions reductions required across all sectors of the economy. While Australia has seen growing investment in climate tech, much of the capital flows to asset-light or software-focused solutions, leaving capital-intensive, scalable technologies without adequate funding. Addressing this gap is critical to achieving the nation’s emissions reduction targets and driving the transition to a low-carbon economy.

The scale of the problem highlights the urgent need for purpose-built finance to accelerate the deployment of climate solutions both globally and locally.

Solution

Climate solutions that can catalyse abatement in the near to medium term are often capital-intensive. For example, funding electric vehicle fleets and/or charging infrastructure, battery manufacturing and green hydrogen production all require significant capital investment in physical assets to deliver climate benefits. These example businesses are not asset-light software businesses that can meet venture capital mandates. While they may be attractive business models for private equity, they are often too early with too much commercialisation risk.

The Planet Fund intends to fill this gap, with a mandate that enables investment in companies that may be asset-intensive in nature. The Planet Fund will offer tailored, structured financing solutions—whether they require debt, equity, or a combination of both. The Fund will invest in solutions with proven technology, the ability to deliver near term emission reductions, and are profitable, or near profitable.

With the right investment support these climate solutions have the potential to scale to achieve improved gross margins, a lower cost of capital and increased market adoption. In our view, this strategy offers a compelling path to achieving positive climate impact and favourable returns for investors.

Image credit https://onimpact.com.au/ecotones-planet-fund-funding-the-climate-transition/

Planet Fund alleviates the capital constraints faced by climate companies with established technologies that need to access capital to scale. For investors, it provides access to a diversified portfolio of climate-aligned investments that deliver both financial returns and measurable carbon reduction, addressing increasing investor demand for sustainable finance options.

Result

Since its inception, Ecotone Partners has played a pivotal role in advising on and supporting capital raisings and refinancings totaling over $135 million for climate solutions. This capital has been instrumental in helping clients scale their operations, grow their impact, and advance critical climate initiatives.

In early 2024, Ecotone Partners transitioned its focus from capital advisory to launching The Planet Fund, leveraging its deep expertise and established networks to create a dedicated investment platform for climate solutions. We are currently in the market raising capital for the Fund, with plans to achieve our First Close in the first half of next year.

Building on our progress to date, The Planet Fund has achieved several significant milestones that demonstrate our momentum and capability:

- Anchor Funding Secured: The Fund has successfully secured $20 million in anchor funding, signaling strong market confidence in our strategy and mission to bridge the critical funding gap for scalable climate solutions.

- Support from LaunchVic: We have received an establishment grant from LaunchVic, further validating our innovative approach to addressing the "missing middle" in climate finance and underscoring our alignment with broader ecosystem development goals.

Strong deal pipeline: Leveraging our extensive networks, we have established a robust pipeline of high-potential opportunities.

The Planet Fund is focused on scaling its impact by catalysing greater investment into climate solutions and supporting the broader climate finance ecosystem. Our immediate goal is achieving the First Close by mid-next year, with plans to grow the Fund over time.

Looking Ahead

Our evergreen structure enables us to keep adding new capital to the Fund over time, which in turn will enable us to write larger cheques and support climate scale-ups as their capital needs grow and evolve over time.

We aim to build a robust portfolio that accelerates the commercialisation of technologies capable of achieving near-term emissions reductions. This strategy is designed not only to deliver measurable impact but also to strengthen the broader climate finance ecosystem, offering investors access to innovative, scalable opportunities that drive significant financial returns and meaningful climate outcomes. - Amanda Goodma, Partner, Planet Fund

Contact

Website: https://www.ecotonepartners.com.au/planet-fund

Newsletter: https://www.ecotonepartners.com.au/stay-connected