Breadcrumb

- Home

- Industry Insights

- Climate Tech funding triples

Climate Tech funding triples

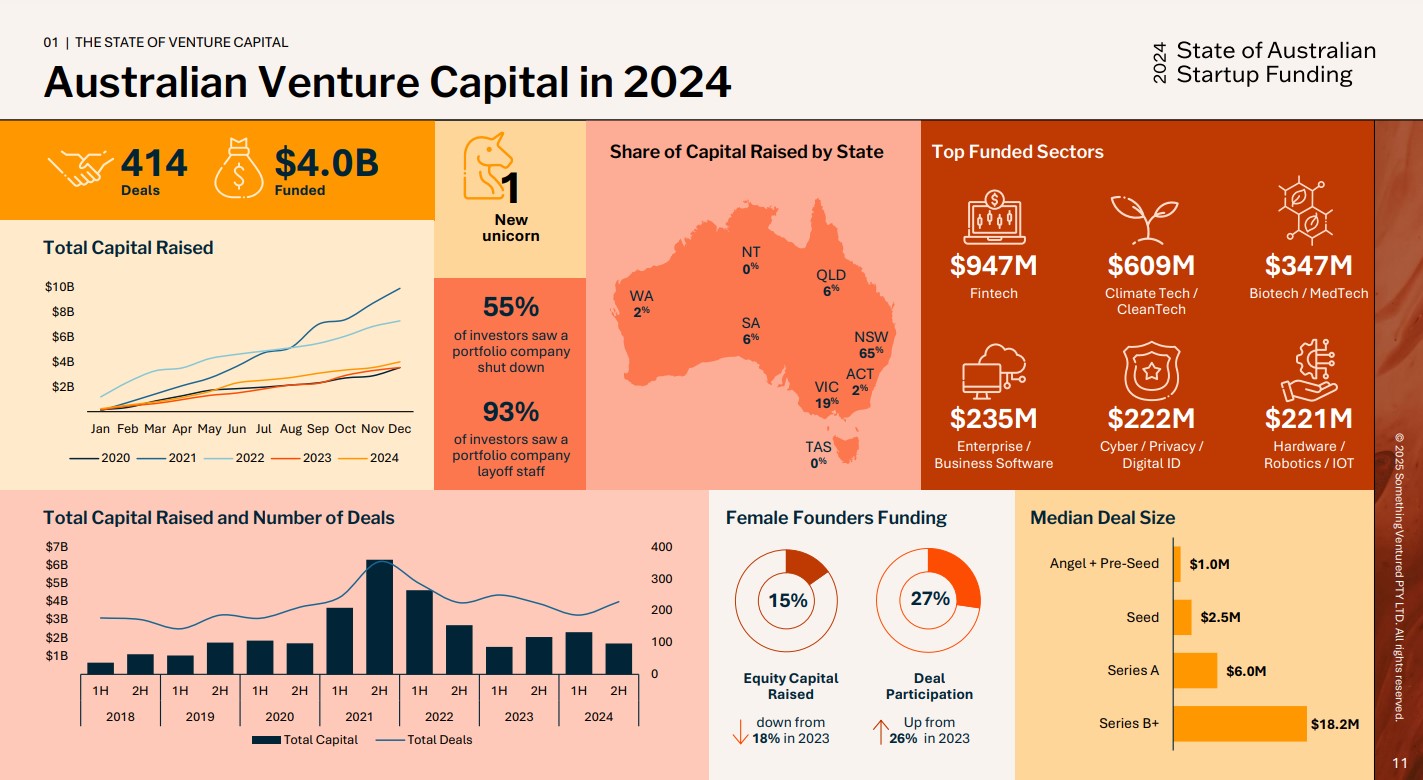

The State of Australian Startup Funding Report is out and climate tech continues to shine.

Cut Through Ventures and Folklore have released the state of Australians Startup Funding Report for 2024 and again Climate Tech comes out as a leader of this data driven detailed view of Australian startups.

Australian startups have raised $4.0 billion and a reinvigorated ecosystem brimming with optimism for the year ahead.

Cut Through Venture and Folklore Ventures gathered input from over 100 industry experts and analysed nearly 1,000 survey responses to provide deeper insights.

At the Melbourne Climate Network we pulled out a few key details on climate tech:

- Climate tech again took out top spot for deals with 55 deals!

- Tripled funding, of those 55 deals $609M was raised but on closer look and because of climate tech's broad definition that figures is closer to $846M which is more than triple the $268M raised last year.

- 24% of those deals in climate tech involved a female founder!

- Optimism for climate tech funding is high despite a challenging environment in 2024. The continued flow of capital and growing maturity in the sector point to a positive long-term trend.

- Climate tech ranked among the top three sectors by deal volume in Australia. Companies demonstrating strong fundamentals continue to access significant capital both domestically and internationally.

- There is a substantial amount of "dry powder" earmarked for climate tech, with US$86 billion available globally. New funds raised for climate investments increased by 20% in 2024, indicating capital is ready to be deployed.

Investors are now more cautious and selective, favouring capital efficiency and solid business fundamentals. There is a renewed focus on proven businesses with mature technologies and clear paths to profitability. Venture capital is giving way to growth equity, private equity, and infrastructure funds that offer more predictable returns.

Several key trends will influence climate tech funding in 2025:

- Successful exits are crucial for maintaining investor confidence.

- First-of-a-Kind (FOAK) projects will rely on blended capital approaches, including philanthropy, corporate balance sheets, and government support.

- Clarity on regional approaches to climate incentives, such as tax credits and carbon market mechanisms, will be important.

- Sectors like AI and clean tech relevant to national security are likely to be preferred by investors.

- Investors will prioritise execution over ambition, favouring cost-competitive and scalable solutions backed by real demand.

- Australia's VC ecosystem shows increased support for early-stage companies, which should positively impact 2025 as opportunities to back world-class founders building advanced technology companies continue.

- Government funding is emerging, such as the Future Fund’s energy transition mandate. A business-friendly environment, emphasis on energy independence, and the push for supply chain security are conducive to climate tech growth.

- Circular economy and waste-to-value opportunities are gaining momentum due to sound economics, proven technologies, and strong legislative support. Corporates seek high-quality and competitively priced offtake opportunities, especially in natural capital, driven by mandatory climate disclosure requirements.

- The influx of capital has created a "missing middle" funding gap for companies scaling up from early stages, making it challenging to commercialise and deploy breakthrough technologies.

- Climate tech companies can enhance their scaling chances by engaging with overseas investors early [11]. Also, climate technologies packaged as complete commercial solutions targeting opex rather than capex budgets are seeing the most traction.

Read the full report here.